pittsburgh pa local services tax

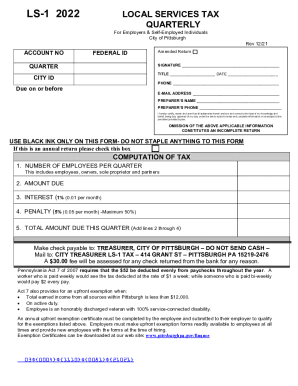

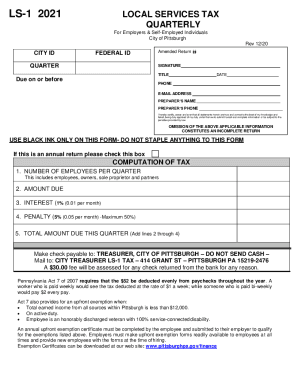

-1 TAX 414. Fee will be assessed for any check returned from the bank for any reason.

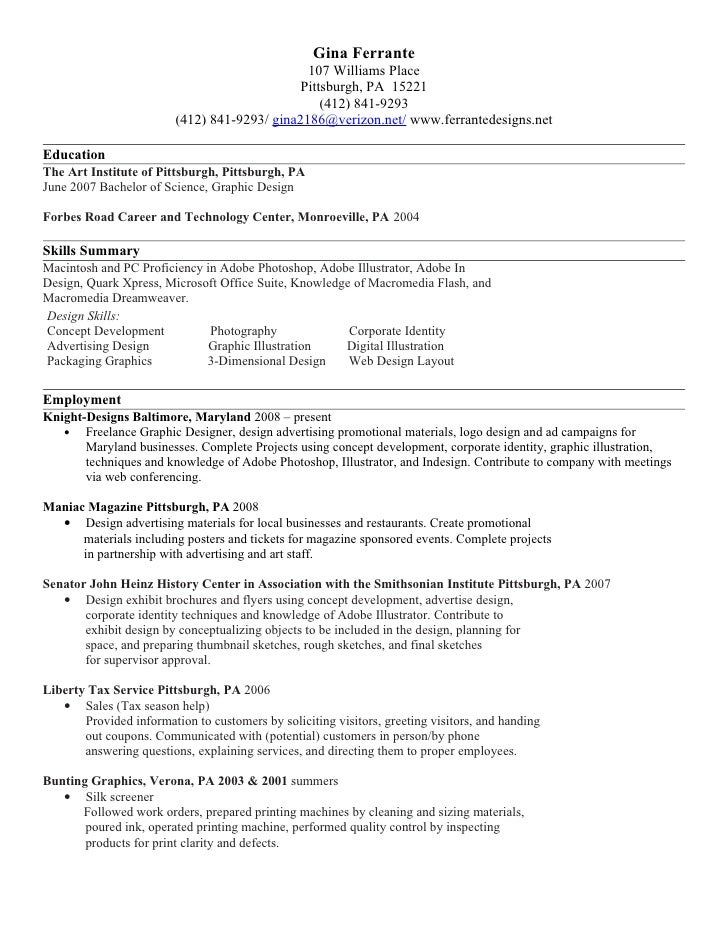

Living In Pittsburgh Pa U S News Best Places

Tax rate for nonresidents who work in Pittsburgh.

. Location or proof that the employer is remitting Local Services Tax or local municipal tax eg. Parking Tax 414 Grant St Pittsburgh PA15219-2476. Below are examples of two generic LST codes one that is a 10 per year tax and is withheld out of one check and the.

If you prefer a refund for 2021 please contact the Finance Department by phone at. City of Pittsburgh Rev 1221. Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the.

Local Services Tax is 5200 per person per year payable quarterly. Business Privilege Tax at that home office location. DCED lacks the legal authority to extend the statutory local filing and payment deadline of.

Pennsylvania Local Services Tax LST. Jordan Tax Service Inc. The Local Services Tax Form as well as instructions that apply to this and other tax types can be found at https.

ARTICLE II IMPOSITION OF TAX SECTION 201 TIME FRAME A Local Services Tax has been levied. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and. Pennsylvania law limits total payment by one person to a maximum of.

Local Services Tax for the municipality or school district in which you are primarily employed. Local Income Tax Information. CITY TREASURER LS-1 TAX 414 GRANT ST PITTSBURGH PA 15219-2476.

For Employers Self-Employed Individuals. City State Zip. LS-1 2021 LOCAL SERVICES TAX QUARTERLY For Employers Self-Employed Individuals City of Pittsburgh Rev 1220 CITY ID Amended FEDERAL ID.

The Deputy Director of Finance serves as City Treasurer. If the taxpayer believes that the Local. All Local Services Tax collections and returns for residents of the Borough are processed through Berkheimer Tax Administrator and no earned income tax records are maintained by.

The Governors Center for Local Government Services GCLGS is a one-stop shop for local government officials and provides a wealth of knowledge. Local Income Tax Requirements for Employers. Any overpayment from the Parks Tax can be applied to your 2022 tax bill if requested.

ACCOUNT NO FEDERAL ID QUARTER. DCED Local Government Services Act 32. Offers comprehensive revenue collection services to all Pennsylvania school districts municipalities counties and authorities including current tax and utility fee.

KPMG - Tax Associate State and Local Tax Pittsburgh Fall 2023 - Pittsburgh - Business Title Tax Associate State and Local - Mashable Job Board. DCED Local Government Services. Pittsburgh PA 15219-2476 The municipality is required by law to exempt.

LS-1 2022 LOCAL SERVICES TAX.

Positions Us And Pennsylvania Leagues Copy League Of Women Voters Of Greater Pittsburgh

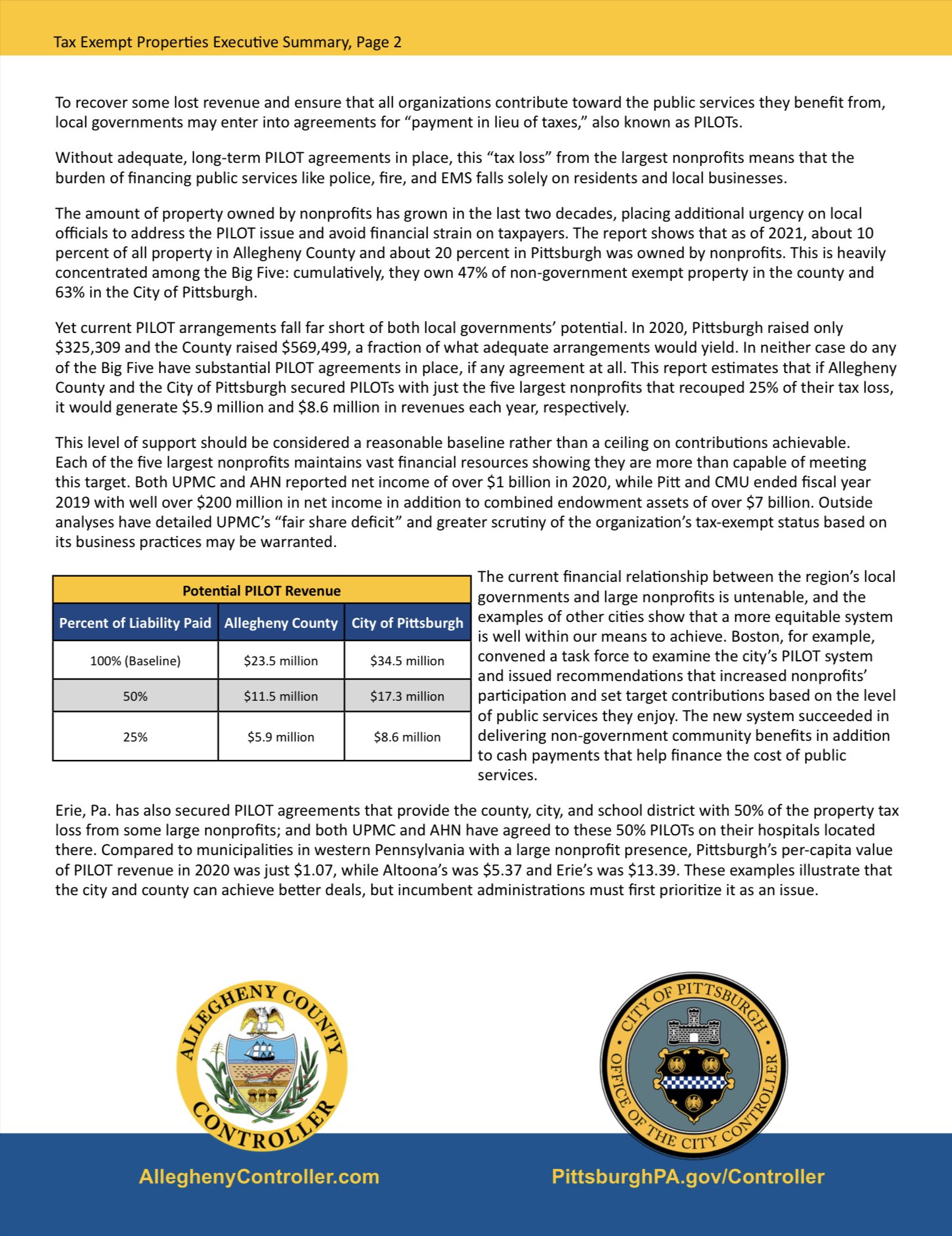

Should Pittsburgh Tax Upmc And The Rich

Pittsburgh Made A Mistake On Thousands Of Tax Bills Triblive Com

Pennsylvania How To Determine Which Local Taxes Should Calculate

Free Tax Return Preparation United Way Partner

Global Advisory Tax Group Welcome

Office Of The City Controller Pghcontroller Twitter

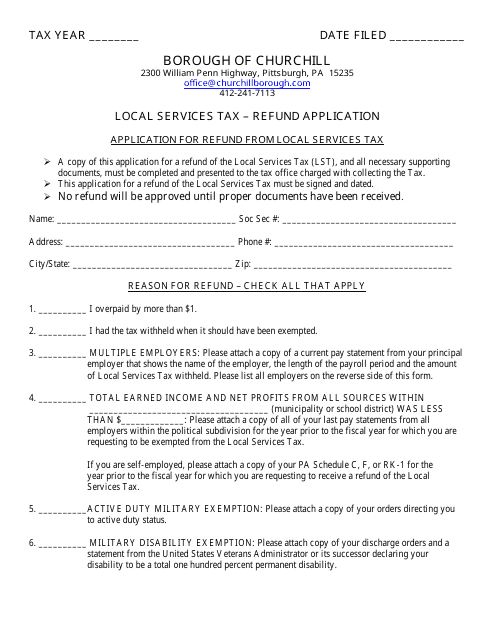

Borough Of Churchill Pennsylvania Application For Refund From Local Services Tax Download Printable Pdf Templateroller

Wilke Associates Llp Pittsburgh Accountant Pittsburgh Cpa

Pennsylvania Payroll Services And Regulations Gusto Resources

2022 Form Pa Ls 1 Fill Online Printable Fillable Blank Pdffiller

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

Ori Number Fill Online Printable Fillable Blank Pdffiller

Jim Depoe Political Director At Ibew Local 29 Pittsburgh Pennsylvania United States Linkedin